Table Of Content

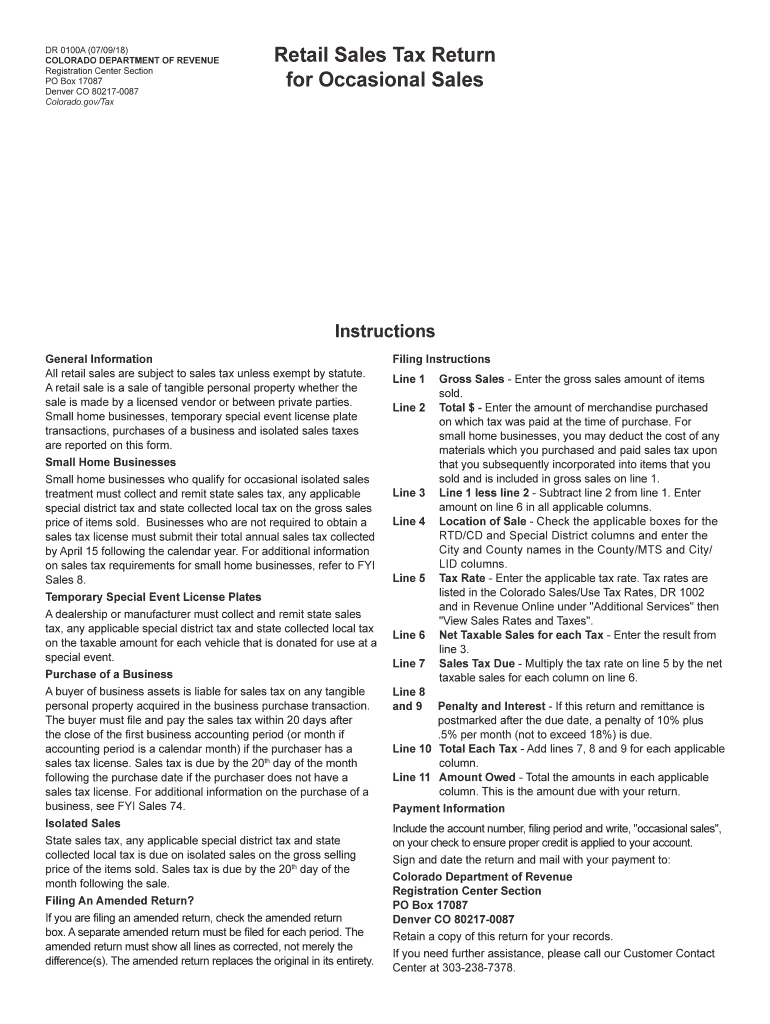

When transferring a home in California, the seller usually pays the tax, but this can be a point of negotiation during the transaction. If left unpaid by the time the sale goes through escrow, then the payment responsibility automatically falls on the buyer. If you don’t quite check all of these boxes, you may still qualify for a partial exclusion of gain. This can happen if the main reason for your home sale is a change in workplace location, a health issue, or an unforeseeable event.

You’re our first priority.Every time.

Taxpayers who file a joint return with their spouse may be able to exclude up to $500,000. Homeowners excluding all the gain do not need to report the sale on their tax return unless a Form 1099-S was issued. However, it’s important to run the numbers with a financial adviser, he says, as there’s a “sneaky” tax called the alternative minimum tax. But changes to that tax came into effect on Jan. 1, 2024 impacting home sales on investment properties. The budget unveiled on April 16 included an increase in the capital gains tax for people who make more than $250,000 in profit on the sale of an asset. Your taxable gain from the sale of your home may be required to be reported on your federal income tax return.

California’s capital gains taxes

You can revoke your choice to suspend the 5-year period at any time. Go to IRS.gov/Forms to download current and prior-year forms, instructions, and publications. However, consulting with a tax professional is a good idea if you need clarification on your eligibility or help navigating the complexities of tax laws. They can provide personalized advice based on your situation and ensure you take full advantage of any available tax benefits.

Avoiding capital gains tax on investment properties

Your expert can work with you in real time and maximize your deductions, finding every dollar you deserve, guaranteed. We’ll search over 350 deductions and credits so you don’t miss a thing. In the past, you may have put off paying the tax on a gain from the sale of a home, usually because you used the proceeds from the sale to buy another home. Under the old rules, this was referred to as "rolling over" gain from one home to the next.

What Is The Capital Gains Tax Rate?

You will continue to receive communications, including notices and letters, in English until they are translated to your preferred language. Go to IRS.gov/Account to securely access information about your federal tax account. If ANY of the three bullets above is true, skip to Determine whether your home sale is an installment sale, later. For each number on your “Total” worksheet, figure the business-related portion of that number and enter it on your “Business or Rental” worksheet. You may use different methods to determine the business portion of different numbers. Here are the three possible methods and the circumstances under which each method applies.

Rocket Mortgage

Learn more about the top tax benefits of real estate investing. Impact on your credit may vary, as credit scores are independently determined by credit bureaus based on a number of factors including the financial decisions you make with other financial services organizations. If you own more than one home, you should conduct a "facts and circumstances" test to make sure the home you're selling will be recognized as a principal residence by the IRS. All features, services, support, prices, offers, terms and conditions are subject to change without notice. For example, if the original cost of the home was $100,000 and you added a $5,000 patio, your adjusted basis becomes $105,000.

Though California is often regarded as a high-tax state, its property and other real estate-related taxes are more middle-of-the-road. This is not an offer to buy or sell any security or interest. Working with an adviser may come with potential downsides such as payment of fees (which will reduce returns). There are no guarantees that working with an adviser will yield positive returns. The existence of a fiduciary duty does not prevent the rise of potential conflicts of interest. Real estate gift tax applies any time an individual transfers property to someone without receiving full market value in return.

How to report your California capital gains taxes

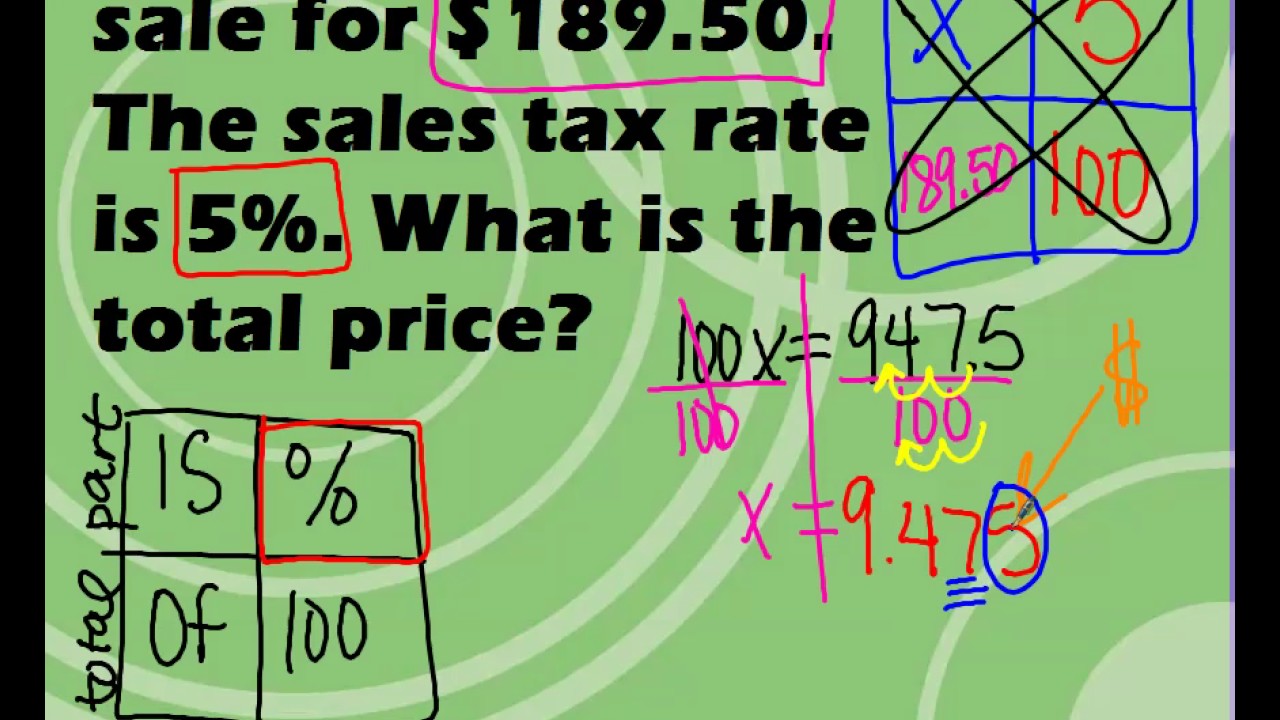

For corporations and trusts, all capital gains regardless of amount will be taxed at the two-thirds inclusion rate. Or to make things even easier, input the Los Angeles minimum combined sales tax rate into the calculator at the top of the page, along with the total sale amount, to get all the detail you need. In the realm of asset sales, the two-year installment sale strategy emerges as a potent tool for optimizing tax outcomes and enhancing overall financial efficiency.

If you received your home as a gift, you should keep records of the date you received it. Record the adjusted basis of the donor at the time of the gift and the fair market value of the home at the time of the gift. As a general rule, you will use the donor’s adjusted basis at the time of the gift as your basis. However, see Table 1 below to determine if any exceptions to this rule listed in the “IF” column apply. If your former spouse was the sole owner, your starting basis is the same as your former spouse's adjusted basis just before you received the home. If you co-owned the home with your spouse, add the adjusted basis of your spouse's half-share in the home to the adjusted basis of your own half-share to get your starting basis.

Proposal to Hike Taxes on Sales of Million-Dollar Homes to Fight Homelessness Gets City Hall Spotlight - WTTW News

Proposal to Hike Taxes on Sales of Million-Dollar Homes to Fight Homelessness Gets City Hall Spotlight.

Posted: Thu, 27 Jul 2023 07:00:00 GMT [source]

Let’s say you bought your home for $150,000 and you sold it for $200,000. Your profit, $50,000 (the difference between the two prices), is your capital gain – and it may be subject to the tax. If you’re selling your primary residence, you may be able to avoid paying the capital gains tax on the first $250,000 gain if you’re a single tax filer and $500,000 for married couples filing jointly. Let's say that your cost basis in a duplex is $250,000 and that you've owned it for 10 years. Over the 10-year ownership period, you've claimed a total of $90,900 in depreciation expense. If you sell the property now for net proceeds of $350,000, you'll owe long-term capital gains tax on your $100,000 net profit plus depreciation recapture on $90,900, which is taxed at your marginal tax rate.

Don’t send tax questions, tax returns, or payments to the above address. If the heirs choose to immediately sell that property for the assessed fair market value, then there are no gains to speak of. When selling an inherited home, many of the same considerations apply as they do to selling any California property. On the state level, California’s Franchise Tax Board (FTB) taxes all capital gains as regular income.

This means that you may be able to meet the two-year use test even if, because of your service, you did not actually live in your home for at least the required two years during the five years prior to the sale. However, the successful implementation of this strategy necessitates a nuanced understanding of tax regulations and financial implications. Collaboration with legal experts, tax advisers and financial planners is essential to ensure compliance and tailor the strategy to suit individual financial objectives. A large tax exemption enjoyed by many American home sellers for the past 27 years has been losing steam recently, according to a new study by CoreLogic. Liz Weston, Certified Financial Planner, is a personal finance columnist for the Los Angeles Times and NerdWallet. Questions may be sent to her at 3940 Laurel Canyon, No. 238, Studio City, CA 91604, or by using the “Contact” form at asklizweston.com.